global wealth report euler hermes | Allianz Global Wealth Report 2020 global wealth report euler hermes The Allianz Global Wealth Report shows that the share of wealth held by the middle class has fallen, except Austria, the Netherlands and South Korea.

United States. (702) 359-9982. http://downtowncontainerpark.com/ Find Downtown Container Park, Las Vegas, Nevada, U.S.A. ratings, photos, prices, expert advice, traveler reviews and tips, and.Discover Downtown Las Vegas. Experience Downtown Container Park, an open-air shopping center filled with boutique retail shops, unique restaurants, and live entertainment for the whole family – located in the heart of Las Vegas! From gourmet quick service dining at Downtown Terrace to award winning cocktails from Oak & Ivy, there’s .

0 · www.eulerhermes.com

1 · Global Wealth Report 2024

2 · Euler Hermes Global Insolvency Index

3 · Allianz Global Wealth Report 2023: The next chapter

4 · Allianz Global Wealth Report 2022: The last hurrah

5 · Allianz Global Wealth Report 2022: Is the middle class

6 · Allianz Global Wealth Report 2020

7 · Allianz

8 · ALLIANZ GLOBAL WEALTH REPORT 2020

9 · 2023 Global Wealth Research Report

2625 S Rainbow Blvd, #D-100. Las Vegas, NV 89146. Book an appointment. Filter by: Specialty: Visit Reason: Dr. Jong Jin, DDS. Dentist. 283. Sat. Oct 14. Sun. Oct 15. Mon. Oct 16. Tue. Oct 17. Complete Dental. 2625 S Rainbow Blvd#D-100 Las VegasNV89146. Find doctors. Specialties. Spring Valley Chiropractors. Spring Valley Dentists.

We would like to show you a description here but the site won’t allow us. Households benefited handsomely: For a third year in a row, global financial assets grew by double-digits in 2021, reaching EUR 233trn (+10.4%). In these last three years, .

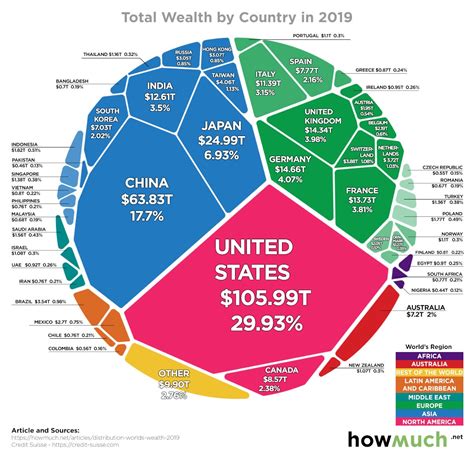

The richest 10% worldwide – 520 million people in the countries in our scope with average net financial assets of EUR 240,000 – together owned roughly 84% of total net .

the bad batch is omega a clone

The Global Wealth Report puts the asset and debt situation of households in almost 60 countries under the microscope.What does the future hold for global wealth? It’s a ques-tion which often comes up in the conversations we have with clients around the world. The answer is encouraging. Our analysis . The Allianz Global Wealth Report shows that the share of wealth held by the middle class has fallen, except Austria, the Netherlands and South Korea.There is no contending EUR 96,630, ranked 9th place in the outpaces the debt growth of +3.3%. that the U.S. is the chart-topper in terms global wealth table (Figure 23). Globally, the net .

The result was a dismal -2.7% decline in private households' global financial assets the strongest drop since the Global Financial Crisis (GFC) in 2008. Growth rates of the .

www.eulerhermes.com

A bar chart showing the historical and projected usage of FinTechs from 2021 through 2026 across Global, Europe, Asia-Pacific and Middle East, with usage in the Middle East expected . Global bankruptcies are still on the rise, implying higher export risks: this is the conclusion of the latest Global Insolvency Report by Euler Hermes, which covers 44 countries .

We would like to show you a description here but the site won’t allow us. Households benefited handsomely: For a third year in a row, global financial assets grew by double-digits in 2021, reaching EUR 233trn (+10.4%). In these last three years, private wealth increased by a staggering EUR 60trn. This amounts to .

The richest 10% worldwide – 520 million people in the countries in our scope with average net financial assets of EUR 240,000 – together owned roughly 84% of total net financial assets in 2019; among them, the richest 1% – with average net financial assets of above EUR 1.2 mn – owned almost 44%.

The Global Wealth Report puts the asset and debt situation of households in almost 60 countries under the microscope.What does the future hold for global wealth? It’s a ques-tion which often comes up in the conversations we have with clients around the world. The answer is encouraging. Our analysis of over 50 key markets in this year’s Global Wealth Report shows the world is getting progressively richer across all wealth seg-ments.

The Allianz Global Wealth Report shows that the share of wealth held by the middle class has fallen, except Austria, the Netherlands and South Korea.

There is no contending EUR 96,630, ranked 9th place in the outpaces the debt growth of +3.3%. that the U.S. is the chart-topper in terms global wealth table (Figure 23). Globally, the net wealth per capita is of wealth, but its Achilles’ heel is the the highest in the U.S. (EUR 209,524). The result was a dismal -2.7% decline in private households' global financial assets the strongest drop since the Global Financial Crisis (GFC) in 2008. Growth rates of the three major asset classes, however, differed markedly.A bar chart showing the historical and projected usage of FinTechs from 2021 through 2026 across Global, Europe, Asia-Pacific and Middle East, with usage in the Middle East expected to grow exponentially, from 8% in 2023 to 41% in three years' time, while in Asia-Pacific the projection is 26% in three years' time, 23% in Europe in three years .

Global bankruptcies are still on the rise, implying higher export risks: this is the conclusion of the latest Global Insolvency Report by Euler Hermes, which covers 44 countries and 87 percent of global GDP and provides the last update of its Global Insolvency Index.We would like to show you a description here but the site won’t allow us.

best swiss omega watch clones

Households benefited handsomely: For a third year in a row, global financial assets grew by double-digits in 2021, reaching EUR 233trn (+10.4%). In these last three years, private wealth increased by a staggering EUR 60trn. This amounts to . The richest 10% worldwide – 520 million people in the countries in our scope with average net financial assets of EUR 240,000 – together owned roughly 84% of total net financial assets in 2019; among them, the richest 1% – with average net financial assets of above EUR 1.2 mn – owned almost 44%.The Global Wealth Report puts the asset and debt situation of households in almost 60 countries under the microscope.What does the future hold for global wealth? It’s a ques-tion which often comes up in the conversations we have with clients around the world. The answer is encouraging. Our analysis of over 50 key markets in this year’s Global Wealth Report shows the world is getting progressively richer across all wealth seg-ments.

The Allianz Global Wealth Report shows that the share of wealth held by the middle class has fallen, except Austria, the Netherlands and South Korea.There is no contending EUR 96,630, ranked 9th place in the outpaces the debt growth of +3.3%. that the U.S. is the chart-topper in terms global wealth table (Figure 23). Globally, the net wealth per capita is of wealth, but its Achilles’ heel is the the highest in the U.S. (EUR 209,524).

Global Wealth Report 2024

Euler Hermes Global Insolvency Index

The result was a dismal -2.7% decline in private households' global financial assets the strongest drop since the Global Financial Crisis (GFC) in 2008. Growth rates of the three major asset classes, however, differed markedly.A bar chart showing the historical and projected usage of FinTechs from 2021 through 2026 across Global, Europe, Asia-Pacific and Middle East, with usage in the Middle East expected to grow exponentially, from 8% in 2023 to 41% in three years' time, while in Asia-Pacific the projection is 26% in three years' time, 23% in Europe in three years .

andrew lessman omega 3 dupe

Allianz Global Wealth Report 2023: The next chapter

Find Tickets to these shows. Explore Other Things to Do in Vegas in April. Explore some of the best concerts to see in Las Vegas in April. Find tickets and see the full concert calendar.

global wealth report euler hermes|Allianz Global Wealth Report 2020